If your account has moved to the new Pay Runs experience, see New Off-Cycle Pay Runs Overview.

This article is an overview of one-time payments within Workforce pay runs.

One-Time Payments Overview

One-time payments are used to manually create earnings for employees (such as bonuses, commissions, or reimbursements) that would not otherwise be created through import, sent from Smart Ops, or included automatically as part of a traditional pay run. One-time payments can also be used to record earnings for tax and reporting purposes that have already been paid to the employee outside of the system.

A single one-time payment can contain earnings for multiple employees. Employees and earning amounts can be added manually or via import template.

One-time payments are also used to import one-time deductions. One-time deductions are primarily used for variable deductions or to rectify deduction errors.

One-time payments are created from the Payroll Overview page using the 'Create Payment' form. Learn more about creating one-time payments here.

One-time payments are always separated out into their own pay runs, which allows for payment outside of the traditional pay cycle. To add earnings to an existing pay run, use the Pay Run Import wizard.

After they are created, one-time payments can be edited from the 'Edit payment' form, as well as from the Payment Details page. The editing options available on the Payment Details page are limited. Learn more about editing one-time payments here.

Learn more about one-time payments and pay runs:

Security

The permissions listed here are associated with one-time payments. These permissions can be added to custom user roles or single users. Learn more about managing permissions and custom user roles here.

Permissions associated with one-time payments are found in the permission tree as follows:

Payroll

Workforce Payroll

Payments

View Payments

Edit Payments

Create Payments

Delete Payments

The permission access report can be used to determine which user roles or users already have these permissions assigned. Learn more about user setup and security here.

Tax Options

When creating a one-time payment, R365 offers the following types of tax methods:

Aggregation: Calculates taxes based on the total of the employee's current and previous payroll payments. The tax is determined by applying a rate to the combined total and then subtracting the taxes already withheld from the prior payment. The remaining amount represents the taxes withheld on the current paycheck. For more information, refer to the current IRS Publication 15 Circular E.

Supplemental Rate: Uses the current flat tax rate of 22%. For more information, refer to the current IRS Publication 15 Circular E.

Previously listed as ‘Flat Rate’.

Employee Elections: Will tax the payment as a regular pay run payment, using the employee's tax forms and withholding information on file to calculate taxes.

Taxes do not apply to the earning type of 'Reimbursement'.

One-Time Payment Form Fields Descriptions

The fields outlined here are shared between both the 'Create Payment' and "Edit Payment' forms. Action buttons and editability vary between the forms. Refer to the Create a One-Time Payment and Edit a One-Time Payment articles for more information.

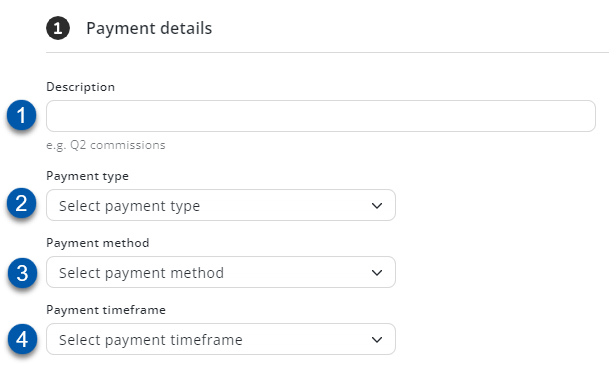

Payment Details

The header contains fields that will be applied to all employees included in the one-time payment.

These details are not editable after the one-time payment is created.

Field | Description | |

|---|---|---|

1 | Description | One-time payment title that will appear on the Payroll Overview page. |

2 | Payment Type | The earning type. This is the earning type added for all employees on the one-time payment. |

3 | Payment Method | Indicates if earnings in the one-time payment need to be processed for payment or if they only need to be recorded for tax and reporting purposes. |

4 | Payment Timeframe | One-time payments are always separated into a new pay run so that they can be paid as soon as possible. |

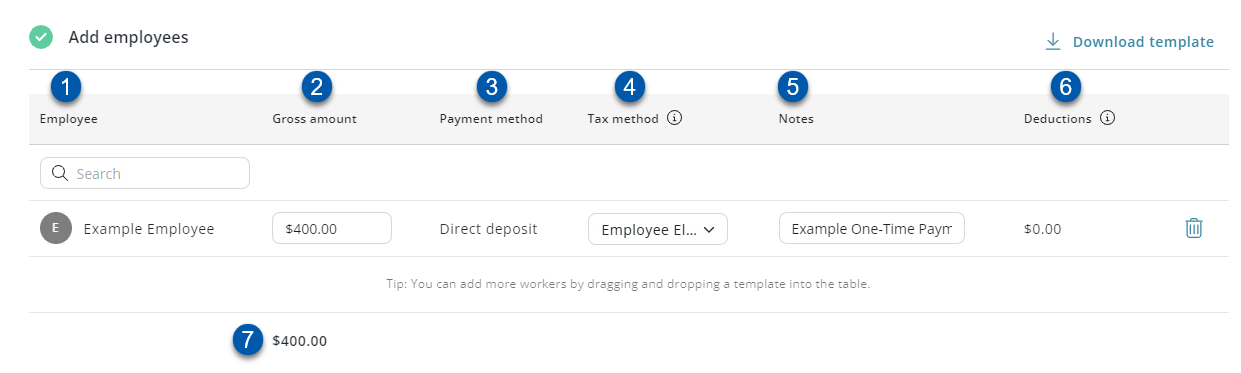

Add Employees Grid

Field | Description | |

|---|---|---|

1 | Employee | Employee receiving the payment. |

2 | Gross Amount | Dollar amount to be paid to the employee. |

3 | Payment Method | Indicates if earnings for the employee need to be processed for payment or if they only need to be recorded for tax and reporting purposes. |

4 | Tax Method | How taxes will be calculated for the payment.

|

5 | Notes | Any employee/payment-specific notes.

|

6 | Deductions | One-time deduction amount. |

7 | One-Time Payment Total | Total gross amount for all employees on the one-time payment. |