If your account has moved to the new Pay Runs experience, see New Create a Off-Cycle Pay Run.

This article covers the steps to create a one-time payment within Workforce.

Action Buttons For the Create Payment Form

Field | Description | |

|---|---|---|

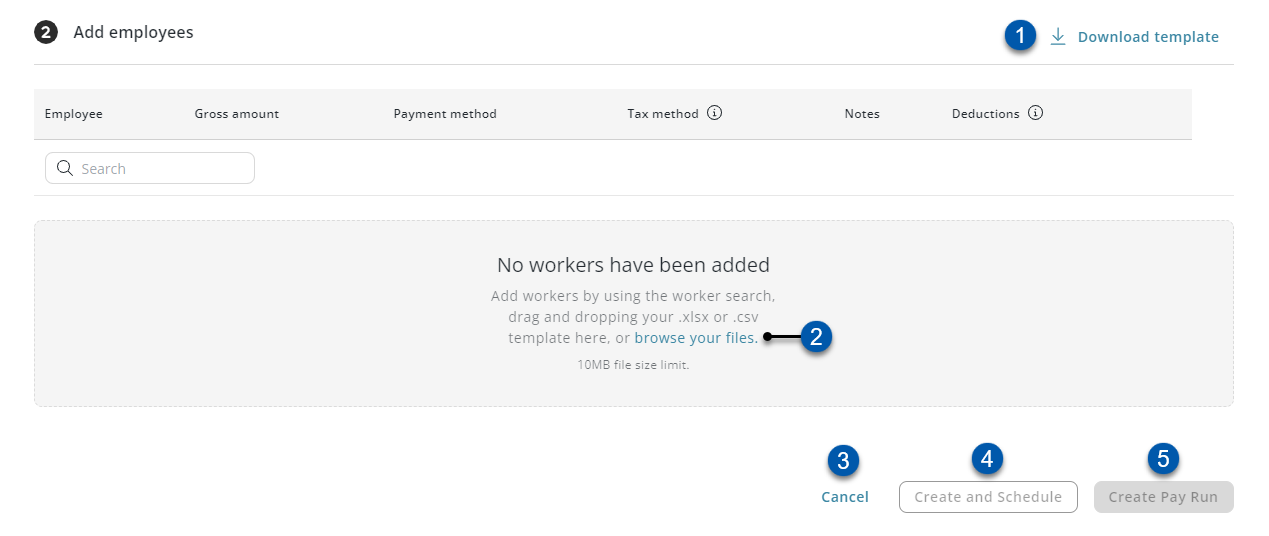

| Download Template | Click to download a blank import template with all active employees listed. |

| browse your files | Click to browse files for a completed import template to upload.

|

| Cancel | Click to cancel the creation of the one-time payment. |

| Create and Schedule | Click to create and calculate the one-time payment.

|

| Create Pay Run | Click to create the one-time payment and return to the Payroll Overview page. |

Create a One-Time Payment Steps

Follow these steps to create a one-time payment:

Clicking on an images in the tables below will expand them to full size

Open a Create Payment Form and Enter Payment Details

Payment Details will not be editable after the one-time payment is created

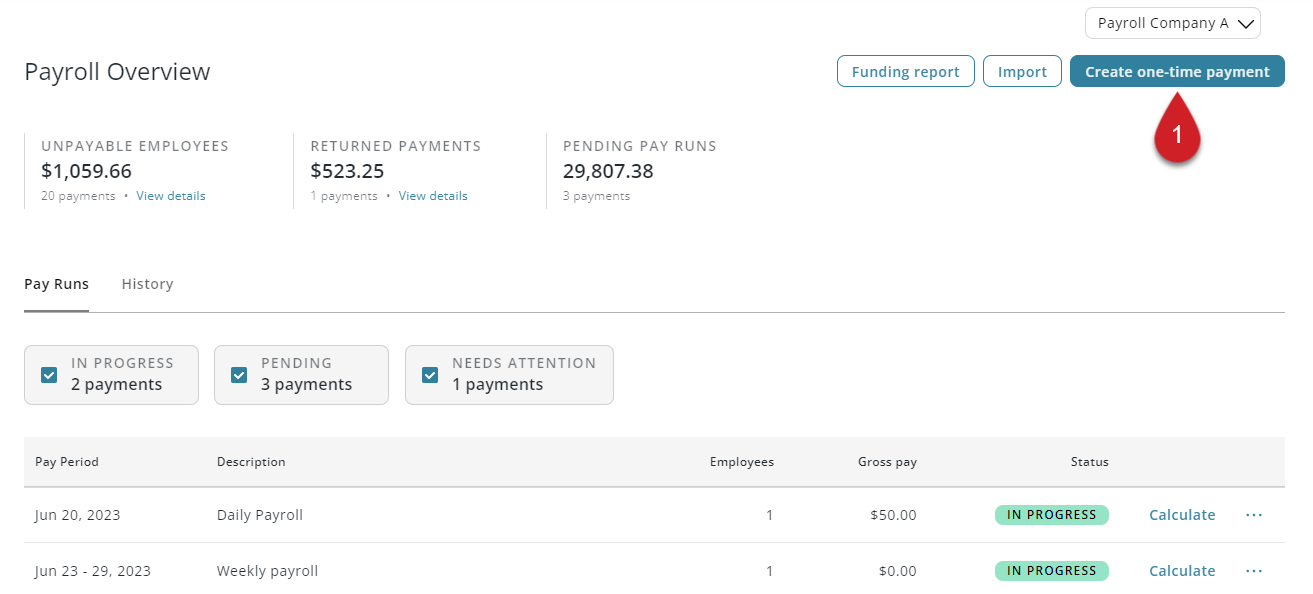

| On the Payroll Overview page, click 'Create one-time payment' |

|

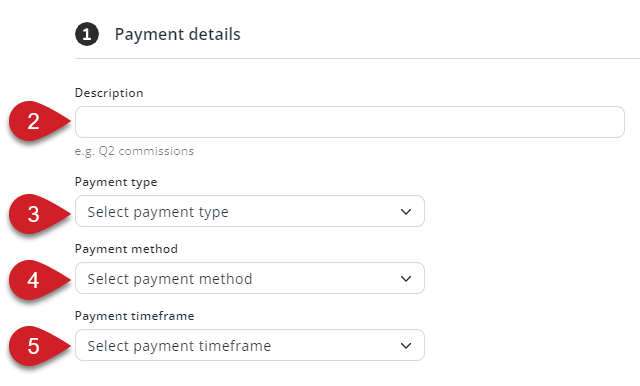

| Enter the Description. |

|

| Select a Payment Type. | |

| Select a Payment Method. | |

| Select a Payment Timeframe.

Grouped with an outstanding/next payment- One-time payment will be grouped with an outstanding/next pay run if available. Otherwise, a new pay run will be created.

|

Add Employees and Earning Amounts

There are two methods for adding employee and earning amounts; manually and import. These methods can be used separately or together.

Manual Entry

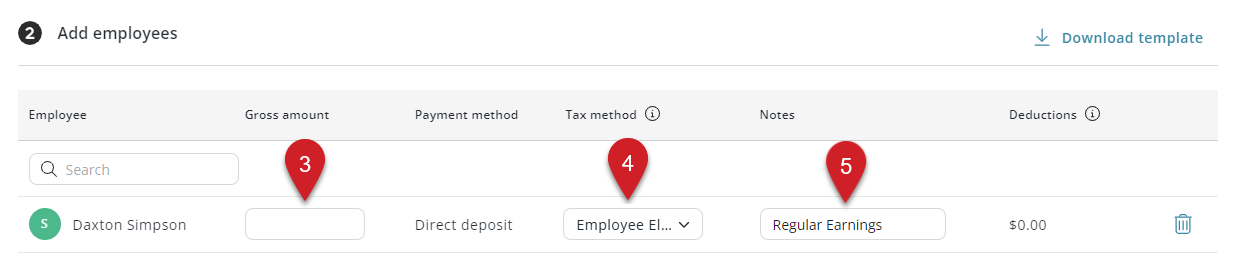

Individual employees are added directly on the 'Create Payment' form

'Notes' field is auto-populated with the selected earning type

Import Entry

One or more employees can be added at the same time with the import template

One-time deductions can be imported with the import template along with earnings

Manual Entry | ||

|---|---|---|

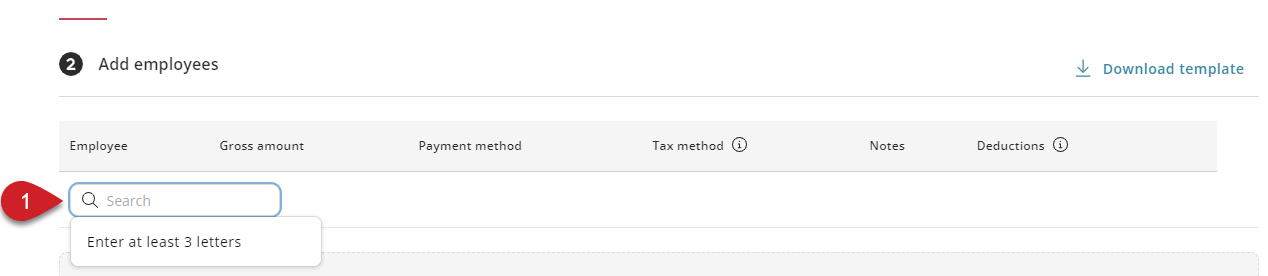

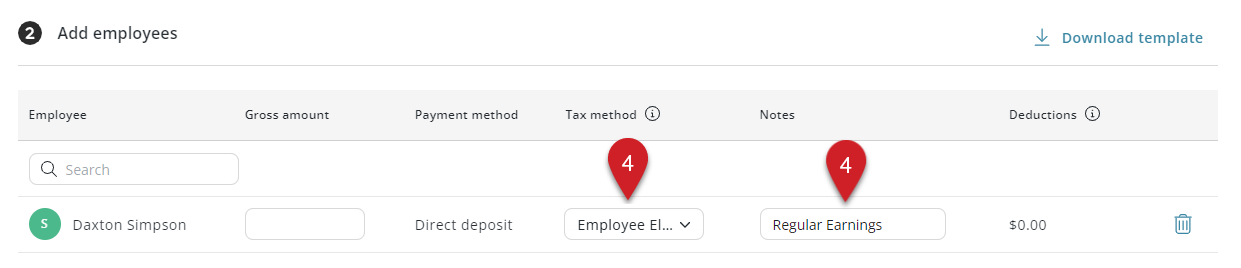

| In the 'Search' box, enter 3 or more letters of the desired employee's name. |

|

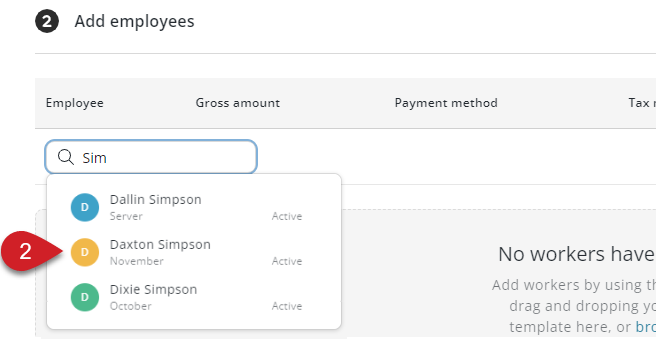

| Select the desired employee. |

|

| Enter the Gross Amount. |

|

| Select a Tax Method. | |

| Edit Notes.

| |

Import Entry | ||

|---|---|---|

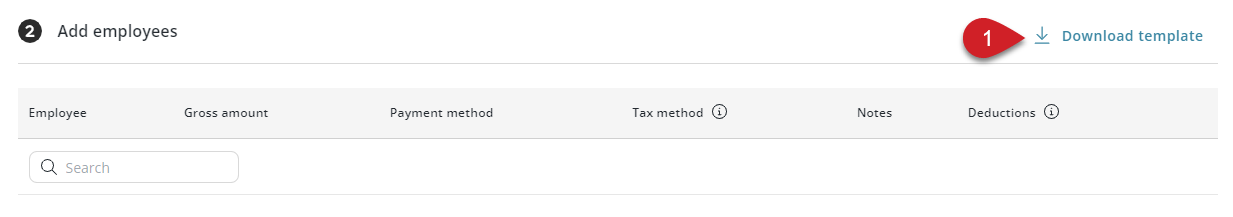

| Click 'Download Template' to download a blank import template with all active employees listed. |

|

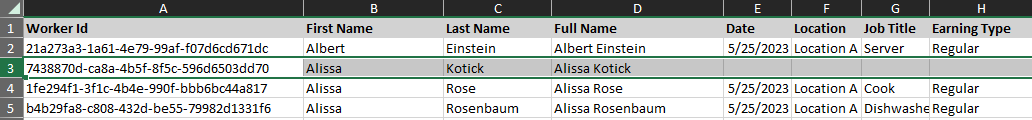

| Fill out the import template with earning amounts and one-time deductions.

|

|

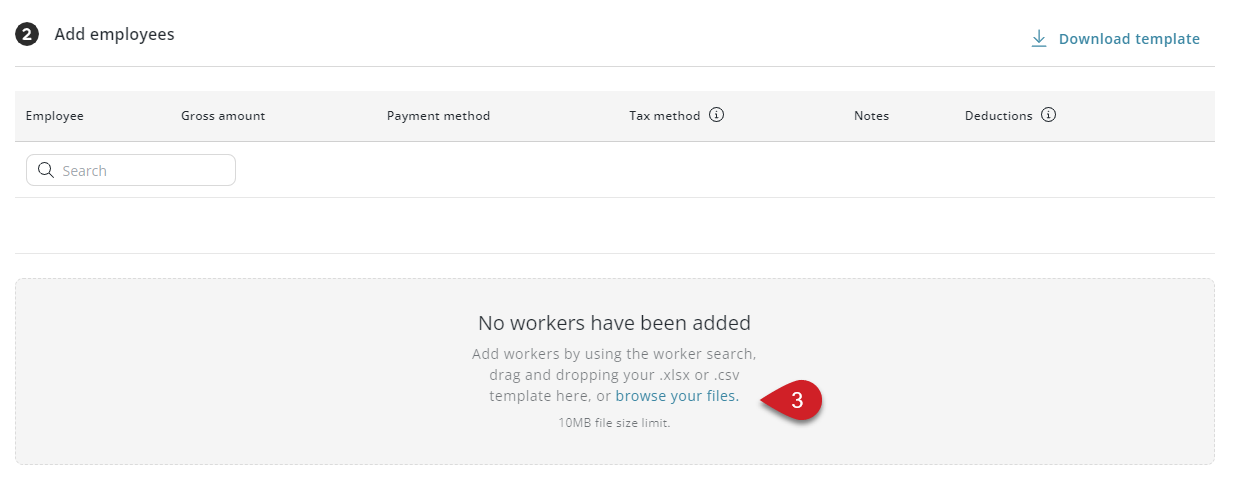

| The completed import template can be uploaded in two ways: Click 'browse your files' to find the file in the file manager.

|

|

| Update Tax Method and Notes. |

|

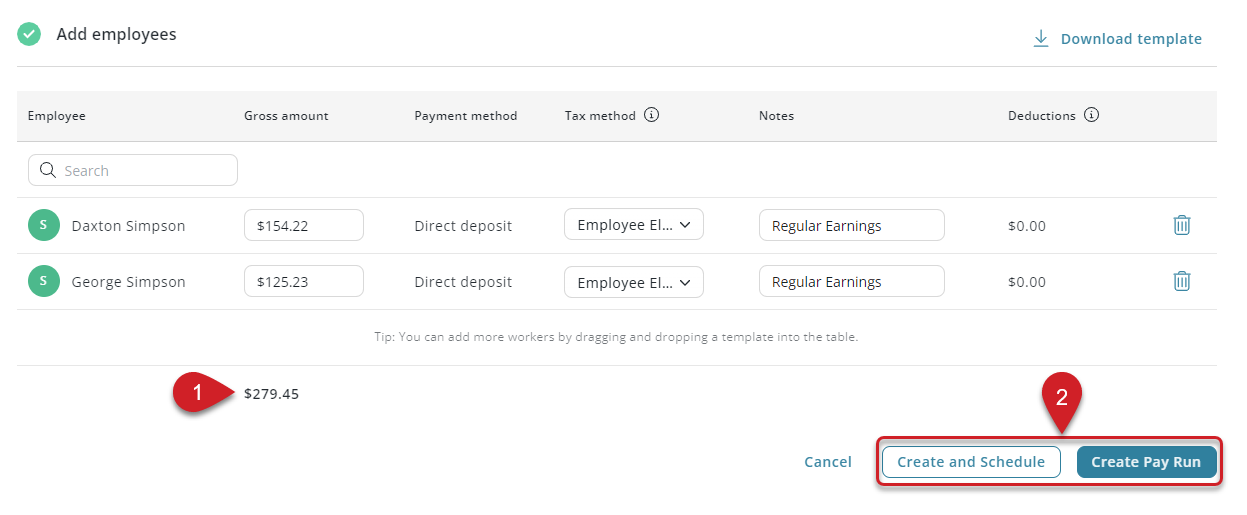

Finalize the One-Time Payment

| Review all added employees and total gross amount for the one-time payment. |

|

| Click 'Create and Schedule' or 'Create Pay Run' to create the one-time payment. |