If your account has moved to the new Pay Runs experience, see New Pay Runs Overview.

Employee earnings are brought into R365 Payroll from the POS via the daily sales summary. Before importing employee earnings, a DSS labor review should be performed for each day being imported. Any punch or tip adjustments can be applied during the labor review.

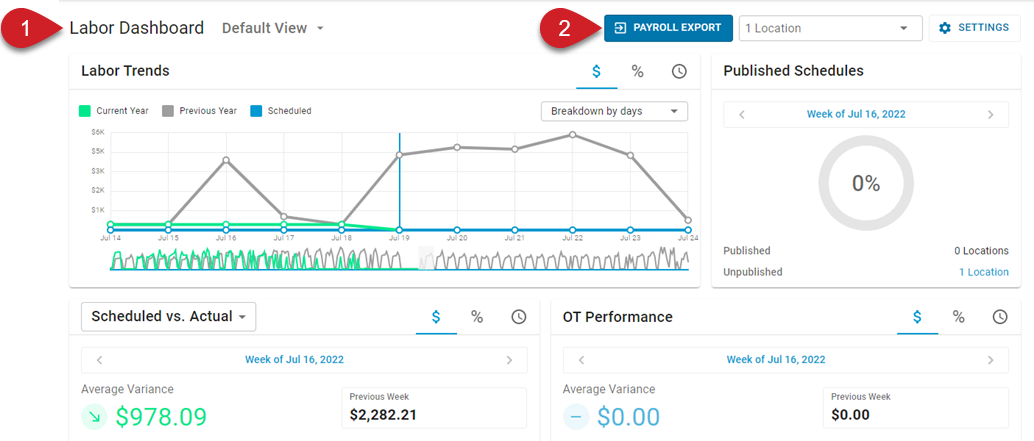

After the DSS labor is reviewed, employee earnings can be exported to R365 Payroll from the Labor Dashboard.

Once employee earnings have been exported to R365 Payroll, the pay run within R365 Payroll should be calculated, reviewed, and approved. Learn more about calculating and approving pay runs here.

Employee earnings cannot be exported to 'approved' pay runs. If the pay run for the selected export period is already approved, the export will fail.

Including Tips

By default, tip earnings are not included when earnings are sent to R365 Payroll.

To include tips, check the Include Tips in Payroll Export option on the associated Legal Entity Record. When tips are included, card tips will be associated with 'Tips' earnings and cash tips will be associated with 'Previously Paid Tips' earnings.

Tip Automation

If tip automation is enabled, 'Tips' earnings and 'Previously Paid Tips' earnings calculated through tip distributions will be included instead of the original POS tip totals. If there are unapproved tip distributions, users will not be able to send earnings to R365 Payroll and a warning message will be displayed.

Learn more about tip automation and tip distribution earnings here.

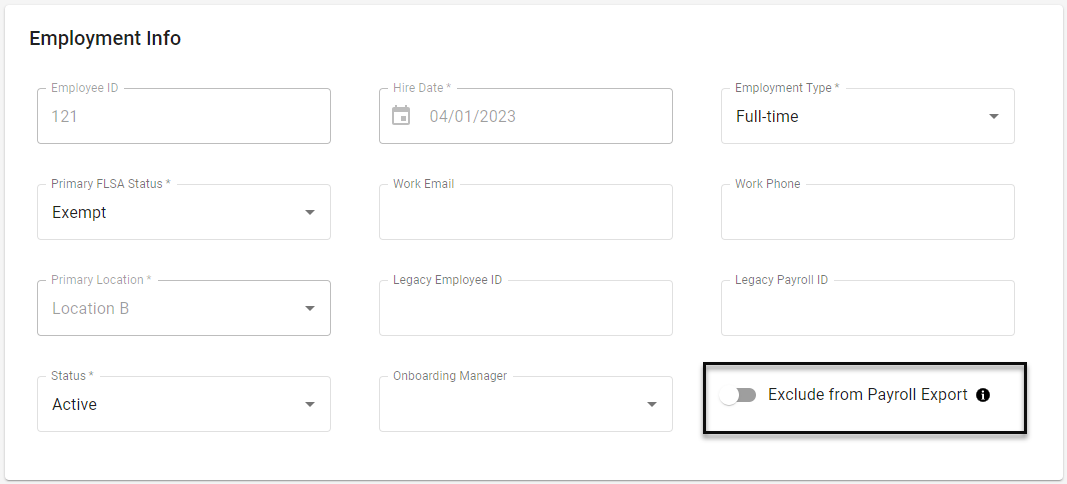

Excluding Salaried Employees

If a salaried employee must punch into the POS in order to access POS functions but their punches are not used for payroll purposes, they should be excluded from the earnings export. This will prevent earnings associated with their POS punches from being imported, resulting in overpayment.

The 'Exclude from Payroll Export' setting is found on the 'Employment Info' section of the 'Employment' tab of Employee Records.

Earnings From Labor Rules

Earnings populated to the DSS from labor rules are included when employee earnings are sent to R365 Payroll. Labor rule earning types include:

Overtime

Break Penalty

Split Penalty

Clopening Penalty

Tip Credit (Tip Makeup)

Spread of Hours

Reporting Time Pay

Shift Differential

Learn more about labor rules here.

Preparing for Export

Before exporting employee earnings, the DSS for each day being exported must be reviewed for accuracy, then approved. Any adjustments must be applied in the daily sales summary and/or the POS before exporting to R365 Payroll.

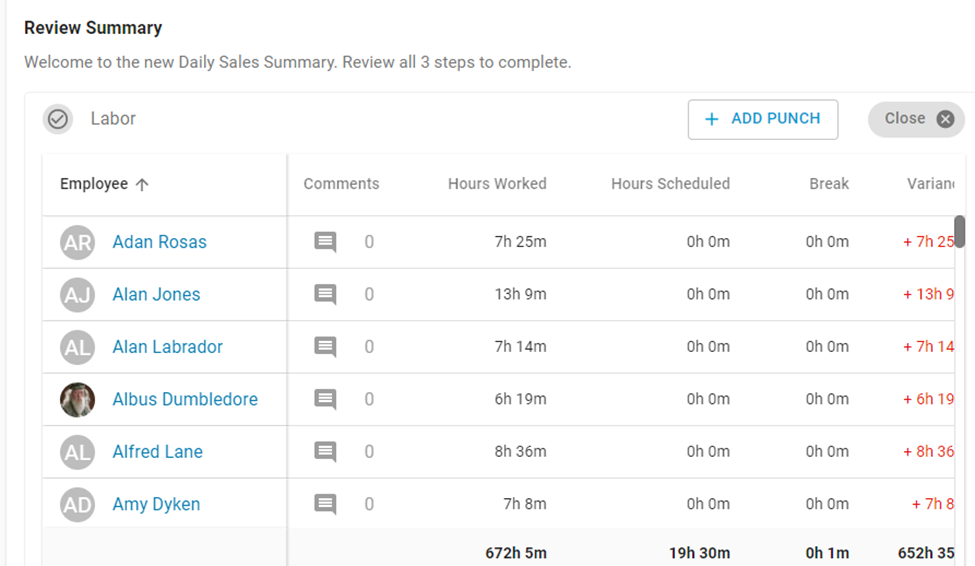

DSS Review - Daily Labor

The DSS labor review is used to confirm that all punches for each employee are accurate. If errors are found, punches must be corrected before the employee earnings are exported.

If the Employee Punch Edit feature is enabled, punches can be edited in R365. Otherwise, punches must be corrected in the POS, and the DSS must be re-imported.

How to Send Employee Earnings to R365 Payroll

Follow these steps to send employee earnings from the Labor Dashboard to R365 Payroll:

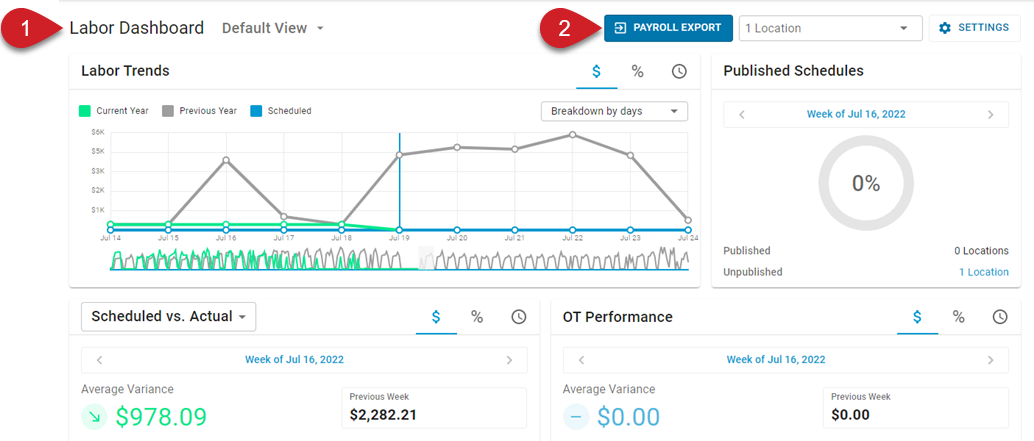

1) Navigate to the Labor Dashboard page, then click Payroll Export.

2) Click 'Payroll Export'.

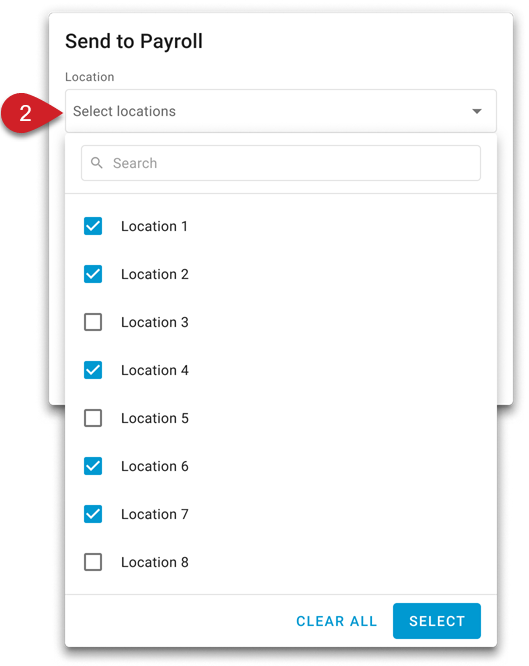

The 'Send to Payroll' window will open.

3) Select the desired locations.

Multiple locations can be selected for simultaneous export.

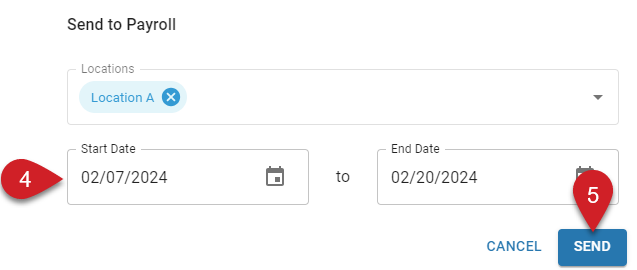

4) Select the date range to export.

5) Click 'Send'.

If a selected location has not been configured for R365 Payroll, a confirmation window will open when 'Send' is clicked. Selecting the 'Go to Locations tab' button will open the R365 Payroll Locations page in a new tab, where the location can be configured for R365 Payroll.

If the location should not be configured in R365 Payroll, it must be removed from the selection before the export can be sent. Click the 'X' icon associated with a location to remove it.

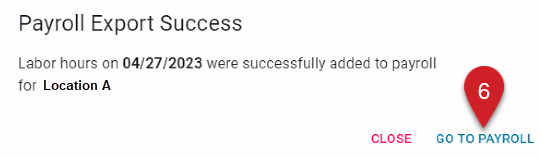

6) Click 'GO TO PAYROLL' to open the Payroll Overview page, where the pay run can be reviewed, calculated, and approved.

Once employee earnings have been successfully exported, a confirmation window will open.