If your account has moved to the new Pay Runs experience, see New Pay Runs Details.

This article reviews the Pay Run Details page within Workforce. Here, users can review the employees included in a pay run, as well as any associated errors.

Navigation

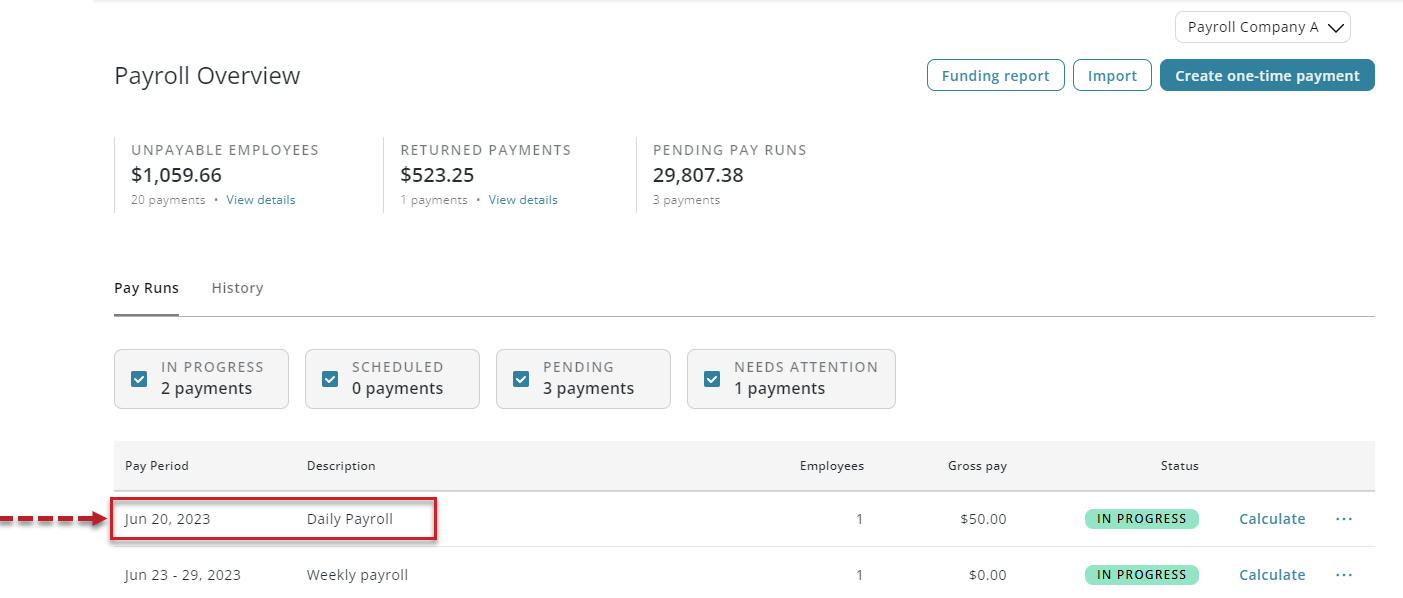

Payroll Overview page

Navigate to the Payroll Overview page.

Click on the desired pay run to open the associated Pay Run Details page.

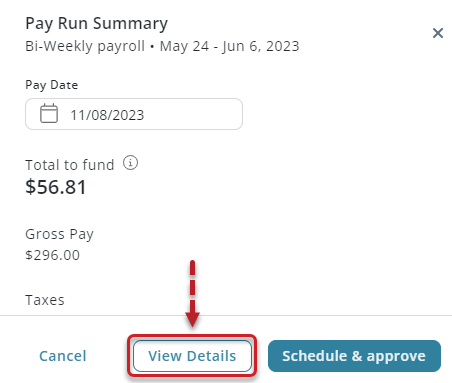

Pay Run Summary Sidesheet

As part of the calculate, review, and approve process, open the pay run summary sidesheet.

Clicking View Details to open the Pay Run Details page.

Pay Run Details Grid

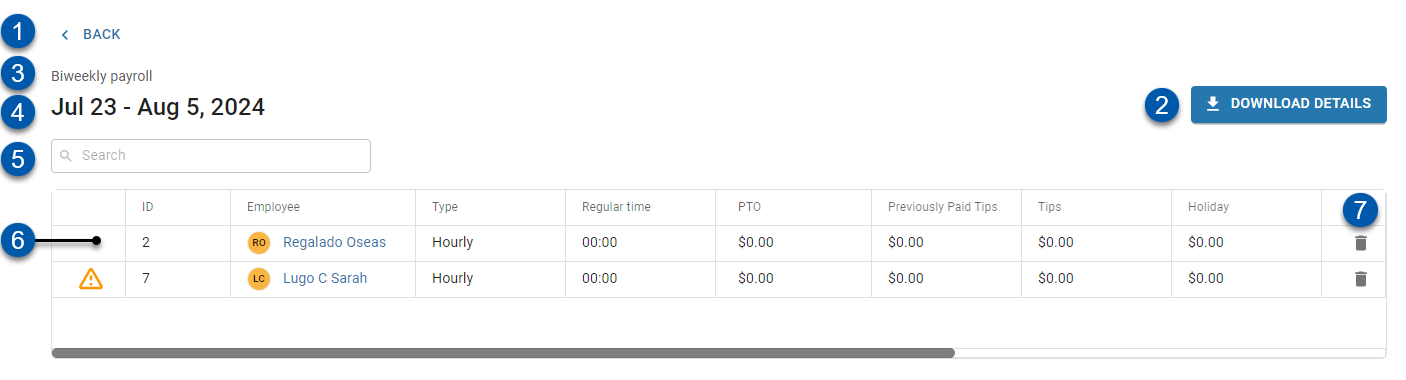

The Pay Run Details page displays all payments within the pay run.

Field/Button | Description | |

|---|---|---|

1 | Back Button | Click to navigate back to the Payroll Overview page. |

2 | Download Details Button | Click to download the the Payment Report which contains pay run details in .xlxs format.

|

3 | Pay Run Description | Traditional pay runs are automatically described as their pay period type. |

4 | Pay Run Date Range | Dates included in the pay run. |

5 | Search | Filters the list of payments for employees whose names contain the entered text. |

6 | Employee Payment | Payment in the pay run. Click to open the associated Payment Details page. |

7 | Trashcan (delete) button | Deletes the employee from the pay run. Deleting the employee will remove the employee and all associated earnings and deductions from the pay run. This action is irreversible.

|

Grid Columns

Grid columns can be sorted in ascending or descending order by clicking the column header name.

Column | Description |

|---|---|

Alerts |

Hovering over the alert icon will show alert information for that payment. |

Employee | Name of the employee receiving the payment. Click to open the employee’s employee record. |

Type | Pay type for the employee; either 'Hourly' or 'Salary'. |

Regular Time | Total regular hours included in the payment.

|

Overtime | Total overtime hours included in the payment.

|

Double Time | Total double time hours included in the payment.

|

PTO | Total dollars paid for PTO hours. |

Previously Paid Tips | Tips that have already been paid to the employee. |

Tips | Tips that are owed to the employee. |

Holiday | Total dollars paid for holiday hours. |

Gross Pay | Total dollars paid for all hours/salary. |

Net Pay | Total dollars paid to the employee after taxes and deductions.

|

ER Tax | Total tax paid by the employer.

|

Expense | Total amount of the payment (Gross Pay + ER Tax).

|

Payment Error List

Error | Error Text | Suggested Actions |

|---|---|---|

Blocked by Previous Payment | This payment could not be processed because a previous payment has not yet been approved. | Approve all previous pay runs and try again. |

Calculated Net Income is Negative | The calculated net earnings for this payment is negative. This typically occurs when there are more tax or benefits withholdings than gross earnings. | Review the payment details and make the appropriate adjustments. |

Missing Address | This payment could not be processed because the employee address is missing or invalid. | Ensure that the employee has a valid home address configured in their Employee Record. |

Invalid Bank Account | This payment could not be processed because the payee's direct deposit information is invalid. | Ensure that the employee's direct deposit information is valid and try again. |

Missing Bank Account | This payment could not be processed because the payee's direct deposit information is missing or incomplete. | Ensure that the employee's direct deposit information is valid and try again. |

Missing Tax Withholding Info | This payment could not be processed because the payee's tax withholding information is missing. | Ensure that the employee's tax withholding information is valid and try again. |

Missing SSN/TIN | This payment could not be processed because the payee's tax payer identifier (SSN/TIN) info is missing. | Ensure that the employee's SSN/TIN is valid and try again. |

Missing or Invalid Pay Period Settings | This payment could not be processed because the payee's pay period settings are missing or invalid. | Ensure that the associated payroll company's pay period settings are valid or contact R365 Support for assistance. |

Missing Unemployment Insurance Rates | This payment could not be processed because contribution/deduction limits are missing for the current year. | SUI rates are only configurable by the R365 Support Team. Please contact R365 Support for assistance. |

Calculated Payment Failed Validation | One or more calculated values in the payment failed validation. | Review the payment details and make the appropriate adjustments. |

Future Payment Already Finalized | A payment that comes after this one has already been finalized, so this payment cannot be calculated. | Please contact R365 Support. |

Unable to Fund | The funds for this payment did not clear the bank. Ensure there is sufficient money for the funds to clear. | Re-calculate this pay run after making sure there are sufficient funds in the configured Bank Account. |

Unexpected Payment Calculation Issue | An unexpected issue was encountered while calculating this payment. | Please contact R365 Support. |

Red Circle with Red Exclamation Mark Icon - Indicates that the payment has an error.

Red Circle with Red Exclamation Mark Icon - Indicates that the payment has an error. Yellow Triangle with Yellow Exclamation Point Icon - Indicates that the employee's net pay is insufficient to cover all required tax withholdings, deductions, and garnishments.

Yellow Triangle with Yellow Exclamation Point Icon - Indicates that the employee's net pay is insufficient to cover all required tax withholdings, deductions, and garnishments.