If your account has moved to the new Pay Runs experience, see New Funding Page & Funding Details Report.

This article reviews the Funding page and Funding Details report. Here, users can view all processed funding transactions and download the associated Funding Details report.

The Funding page is a web-based report that provides an overview of funding transactions by date. From this report, the Funding Details page can be opened for a selected funding transaction.

The Funding Details report can be downloaded directly from the Payroll Reports page or from the Funding Details page once opened.

Navigation

The Payroll by Pay Period and Payroll by Pay Date reports are can be downloaded from the Payroll reports page.

To download or view the desired report, follow these steps:

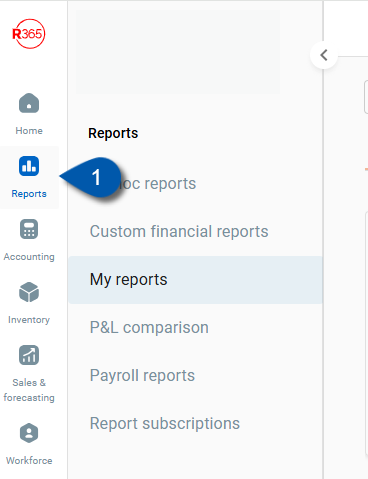

1) In the Workforce application, in the left navigation, click Reports.

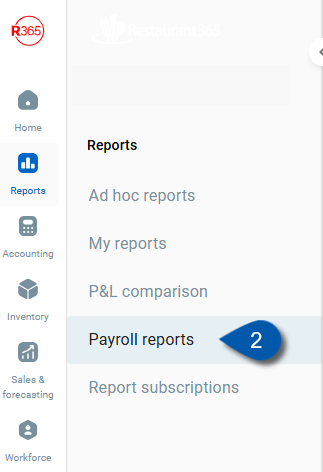

2) Click Payroll Reports.

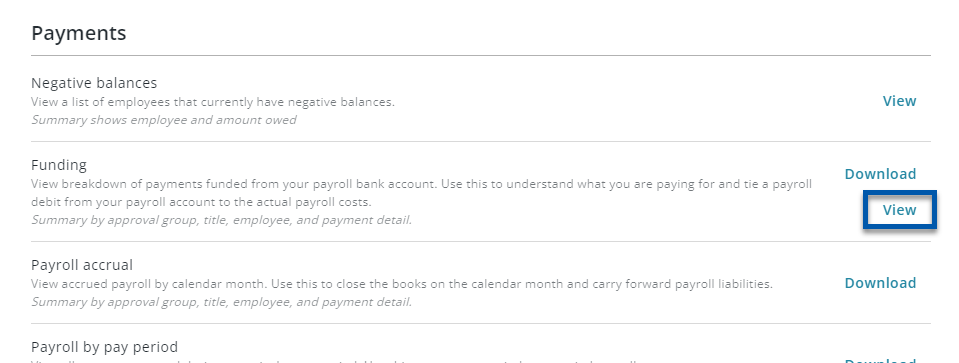

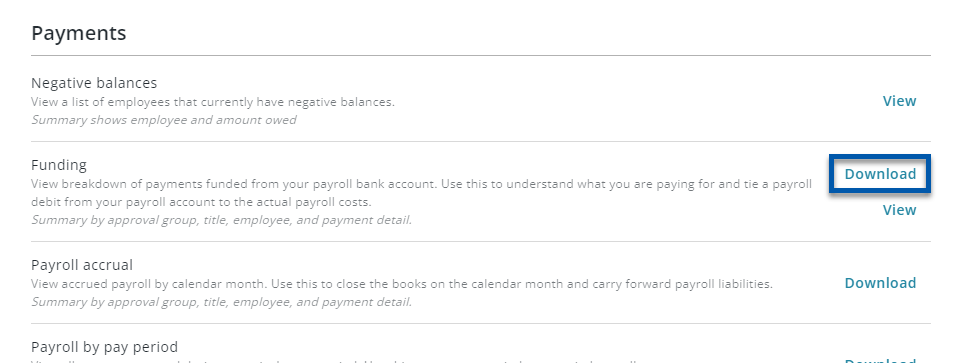

3) Click the desired option in the Funding report row: view or download.

To open the web-based funding page click view:

To download the Funding Details report, click Download.

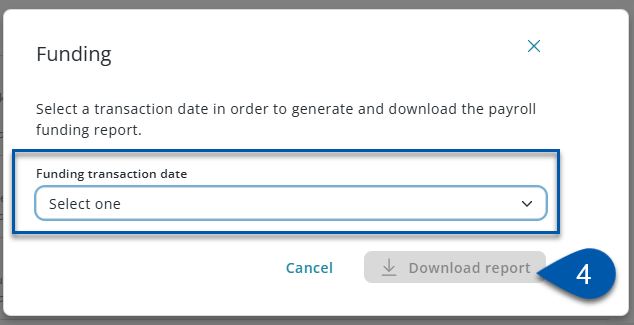

4) Select the desired Funding Transaction Date from the dropdown menu, then click Download Report.

The Funding Details report will be downloaded as a .xlxs file.

Funding Page

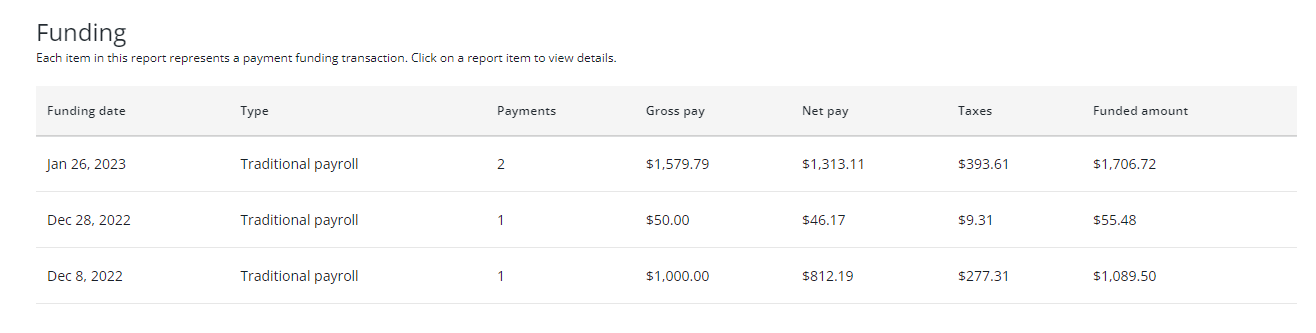

The Funding page lists all funding transactions. Clicking on a funding transaction will open the Funding Details page for that transaction.

Columns

Column | Description |

|---|---|

Funding Date | Date the funding transaction was created. |

Type | Payroll type: traditional payroll or Pay365. |

Payments | Number of payments in the transaction. |

Gross Pay | Employees' gross pay. |

Net Pay | Employees' net pay. |

Taxes | Total taxes (Employee-paid and Employer-paid). |

Funded Amount | The sum of net Pay and taxes.

|

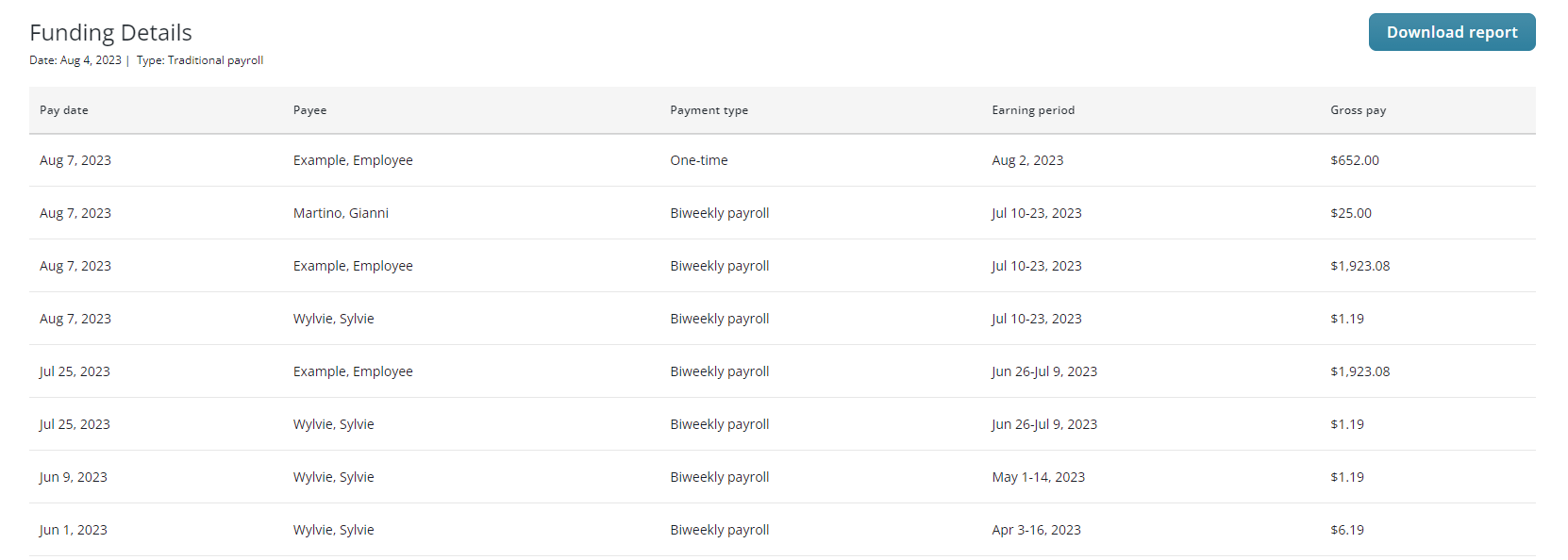

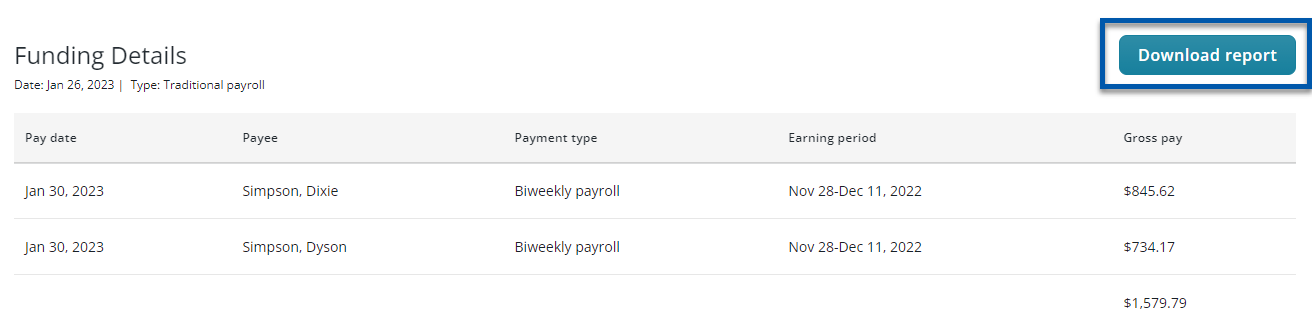

Funding Details Page

The Funding Details page lists all payees associated with the funding transaction.

Columns

Columns | Description |

|---|---|

Pay Date | Date payee received payment. |

Payee | Employee who is the recipient of the payment. |

Payment Type | Pay Cycle of the Payroll Batch associated with the funding transaction. |

Earning Period | Date range of the Payroll Batch associated with the funding transaction. |

Gross Pay | Gross pay associated with the payee. |

Downloaded Funding Details Report

To download the Funding Details report, click the 'Download report' button.

Report Pages

The downloaded report will have multiple pages:

Cover Page - Displays general information and report totals.

Summary by Department - Displays Employee details, subtotaled by department.

Summary by Title - Displays Employee details, subtotaled by Job.

Summary by Employee - Displays Employee details without subtotals.

Payment Detail - Displays full payment details for each Employee.

For Payroll Runs that have been calculated, each earning and deduction associated with the payments will be listed in additional columns.

One-Time Payment Details - Displays details from One-Time Payments.

If no One-Time Payments were included, the page will be blank.

Pullback- Displays details for payments that were pulled back in the selected time-frame.

For Payroll Runs that have been calculated, each earning and deduction associated with the payments will be listed in additional columns.

If no payments were pulled back for the selected time frame, the page will be blank.

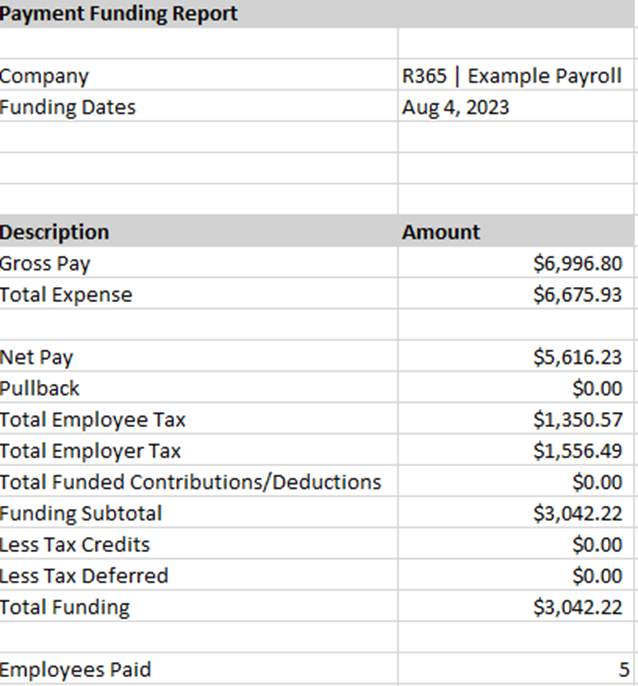

Cover Page

The cover page displays general information and report totals for all Employees in the selected period:

Columns

Column | Description |

|---|---|

Company | Payroll Company included in the report. |

Funding Dates | Date range for the report. |

Net Pay | Total net pay for reported Employees |

Pullback | Total pullback for reported Employees. |

Total Employee Tax | Total taxes paid by Employees. |

Total Employer Tax | Total taxes paid by the Employer. |

Total Funded Contributions/Deductions | Total amount of Employee deductions and Employer contributions funded. |

Funding Subtotal | Funding amount before tax credits and deferred taxes. |

Less Tax Credits | Amount 'Total Employer Tax' is reduced by taxes associated with tax- deferred wages. |

Less Tax Deferred | Amount 'Total Employer Tax' is reduced by taxes associated with tax- deferred wages. |

Total Funding | Total funding amount. |

Employees Paid | Number of Employees in the report, |

Report Columns

Column | Summary by Department | Summary by Title | Summary by Employee | Payment Details | One Time Payments | Pullback |

|---|---|---|---|---|---|---|

ACH Deposit | X | X | ||||

Amount | X | |||||

Approval Group | X | X | X | X | X | X |

Business Name | X | X | X | X | X | X |

Company ID | X | X | X | |||

Current Payment Preference | X | X | ||||

Deferred Compensation | X | X | X | X | X | |

Department | X | X | X | X | X | X |

Distribution Record | X | X | ||||

Double Time Hours | X | X | X | X | X | |

Earning Notes | X | X | ||||

Earning Type | X | |||||

X | X | X | ||||

Funding Ach Record | X | X | ||||

Gross Pay | X | X | X | X | X | |

Instant Deposit | X | X | ||||

Name | X | X | X | X | X | X |

Net Pay | X | X | X | X | X | |

Note | X | |||||

Overtime Hours | X | X | X | X | X | |

Pay Card Deposit | X | X | ||||

Pay Cycle | X | X | ||||

Pay Date | X | X | ||||

Pay Period End Date | X | X | ||||

Pay Period Start Date | X | X | ||||

Payment ID | X | X | X | |||

Payment Status | X | X | ||||

Payroll Employee ID | X | X | X | |||

Phone | X | X | X | |||

PostTax Deductions | X | X | X | X | X | |

PreTax Deductions | X | X | X | X | X | |

Previously Paid Earnings | X | X | ||||

Pulled Back On | X | |||||

Regular Hours | X | X | X | X | X | |

Title | X | X | X | X | X | X |

Total Contributions | X | X | X | X | X | |

Total Expense | X | X | X | X | X | |

Total Tax EE | X | X | X | X | X | |

Total Tax ER | X | X | X | X | X | |

Work Location | X | X | X | X | X | X |

Worker Type | X | X | X | X | X | X |

Columns and Descriptions:

Columns | Description |

|---|---|

ACH Deposit | Amount deposited to the Employee's direct deposit account. |

Amount | Amount of the One-Time Payment. |

Approval Group | Approval Group the Employee is assigned to. |

Business Name | Name of the business associated with contractors. |

Company ID | Company's ID associated with R365 Payroll. |

Current Payment Preference | Employee's Primary Location for the Payroll Company. |

Deferred Compensation | Total deferred compensation for the Employee. |

Department | Department the Employee is assigned to . |

Distribution Record | How payment was distributed to the Employee. (ACH, check, pay card). |

Double Time Hours | Total doubletime hours worked. |

Earning Notes | Notes associated with a One-Time Payment. |

Earning Type | Earning Type for the One-Time Payment. |

Employee's email address. | |

Funding Ach Record | ACH Record associated with the Employee's direct deposit for the payment. |

Gross Pay | Total gross pay for the Employee. |

Instant Deposit | Employee's Primary Location for the Payroll Company. |

Name | Employee's full name. |

Net Pay | Total net pay for the Employee. |

Note | One-Time Payment comment. |

Overtime Hours | Total overtime hours worked. |

Pay Card Deposit | Amount deposited to the Employee's pay card. |

Pay Cycle | Employee's pay frequency. |

Pay Date | Pay date for the pay period. |

Pay Period End Date | End date of the pay period. |

Pay Period Start Date | Start date of the pay period. |

Payment ID | Unique ID for the payment. |

Payment Status | Status of the payment to the Employee. |

Payroll Employee ID | Employee's unique identification number within R365. |

Phone | Employee's phone number. |

PostTax Deductions | Total post-tax deductions for the Employee. |

PreTax Deductions | Total pre-tax deductions for the Employee. |

Previously Paid Earnings | Earnings already paid to the Employee. |

Pulled Back On | Employee's Primary Location for the Payroll Company. |

Regular Hours | Total regular hours worked. |

Title | Job associated with the Employee's earnings. |

Total Contributions | Total Employer contributions for the Employee. |

Total Expense | Total Employer expense for the Employee. |

Total Tax EE | Total taxes paid by the Employee. |

Total Tax ER | Total Employer-paid taxes for the Employee. |

Work Location | Employee's Primary Location for the Payroll Company. |

Worker Type | Either employee or contractor. |