If your account has moved to the new Pay Runs experience, see New Import Deductions.

Security

Users must have the following permission to import deductions:

Payroll → Workforce Payroll → Payments → Edit Payments

These permissions can be added to custom user roles or individual users. The Permission Access report can be used to determine which user roles or users already have these permissions assigned. For more information, see User Setup and Security.

Import Deductions

Follow these steps to import deductions to a pay run using the Add Import wizard:

Click steps to expand for additional information and images.

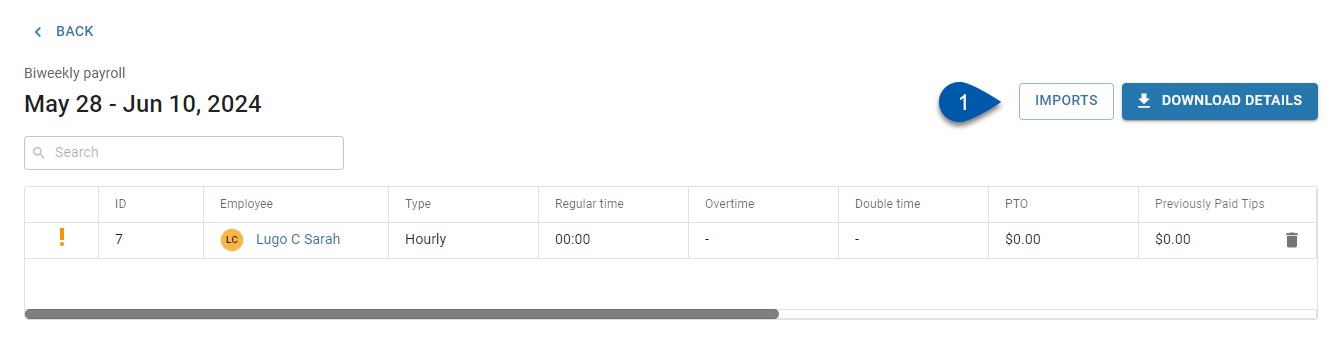

1) Navigate to the Imports page.

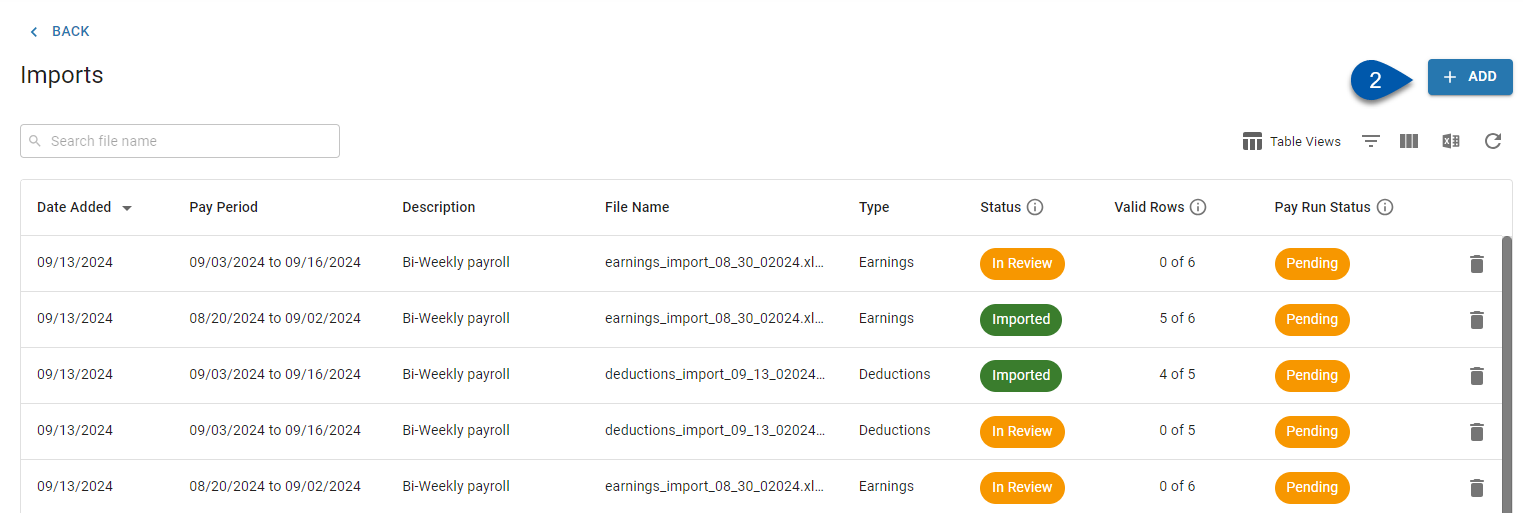

2) Click +Add to open the Add Import wizard.

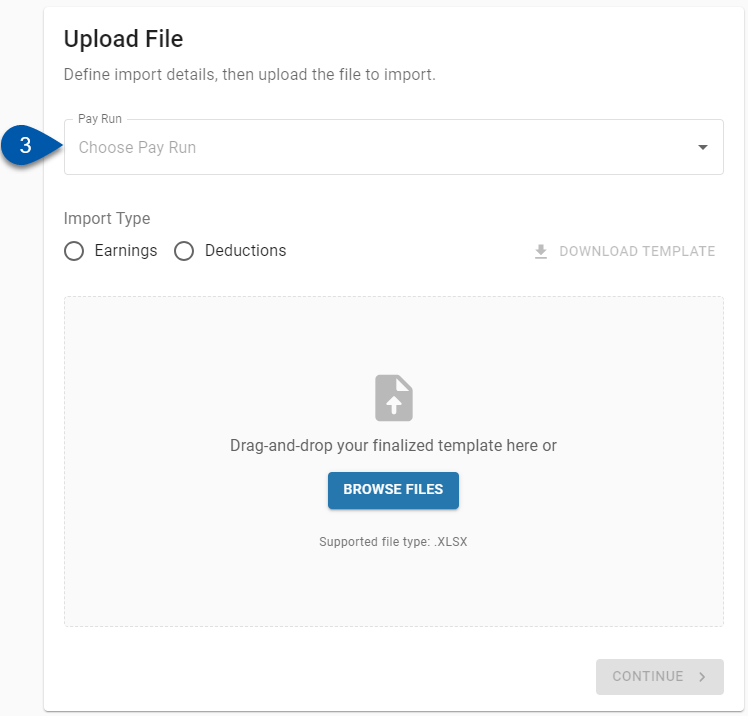

3) Select the desired pay run.

Only pending traditional pay runs with pay period dates in the last 30 days can be selected.

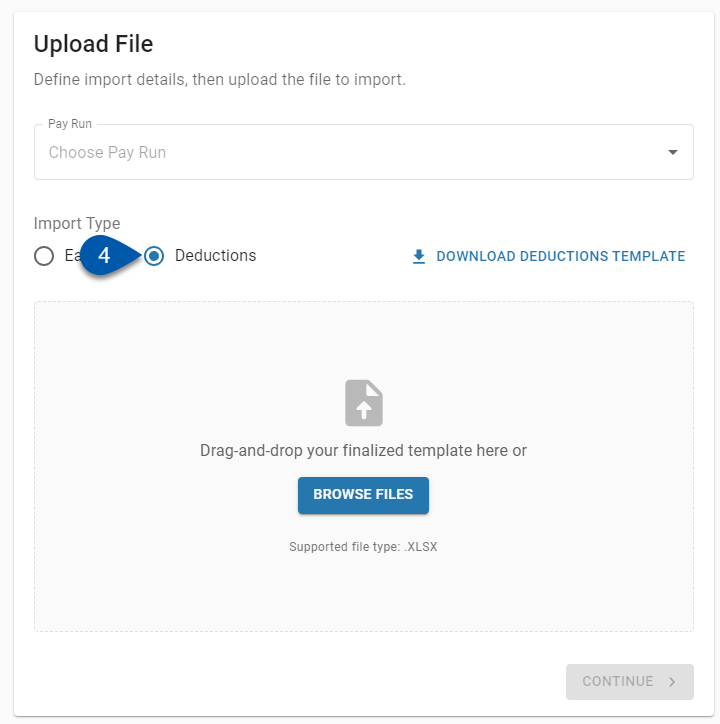

4) Select Deductions.

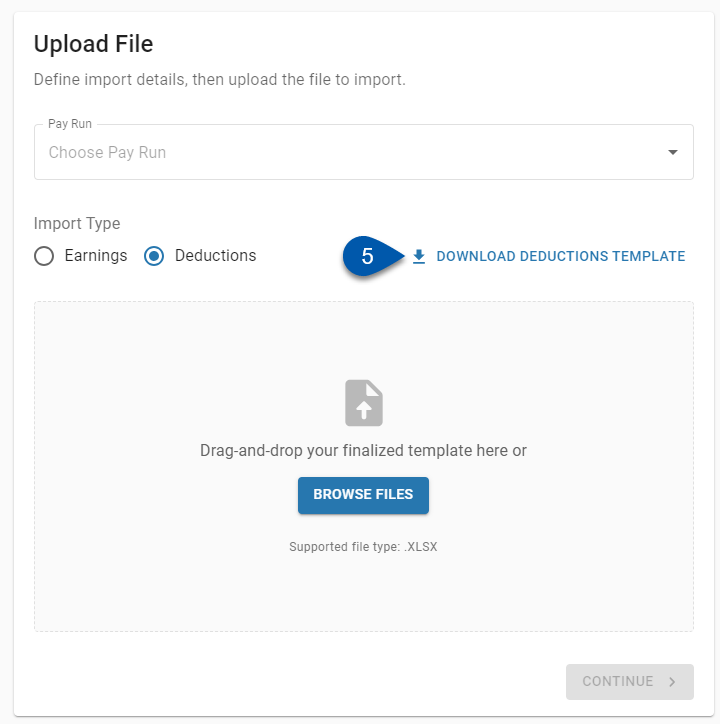

5) Click Download Deductions Template.

When the Deductions Import template is downloaded, all active employees and all valid deduction types are included in the blank template.

6) Enter deduction details into the downloaded Deductions Import template.

Multiple deduction types for the same employee can be imported on the same template by adding additional rows with the employee’s information.

All rows in the Deductions Import template will be checked for validity when it is uploaded. Removing unnecessary employees prior to import reduces rows in the review step of the import process.

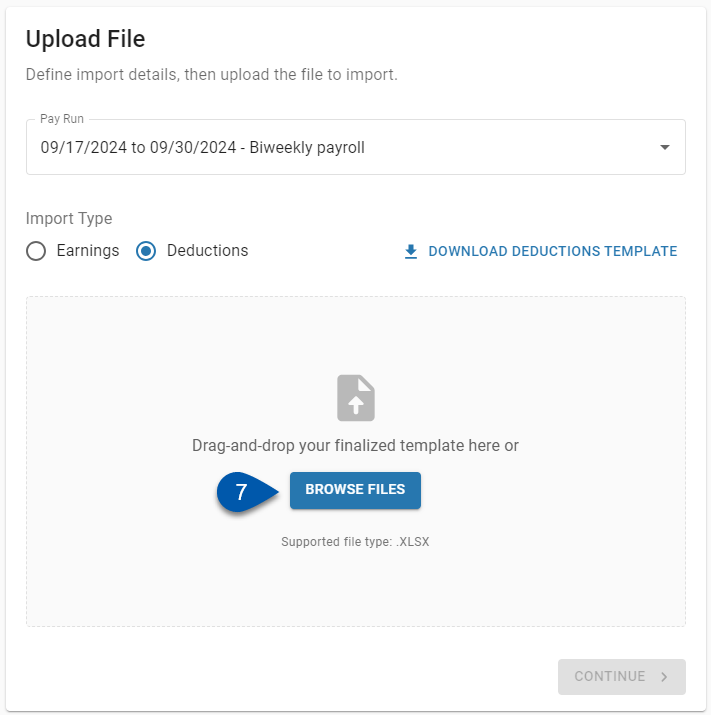

7) Upload the finalized Deductions Import template by clicking Browse Files or by dragging and dropping the file into the upload box.

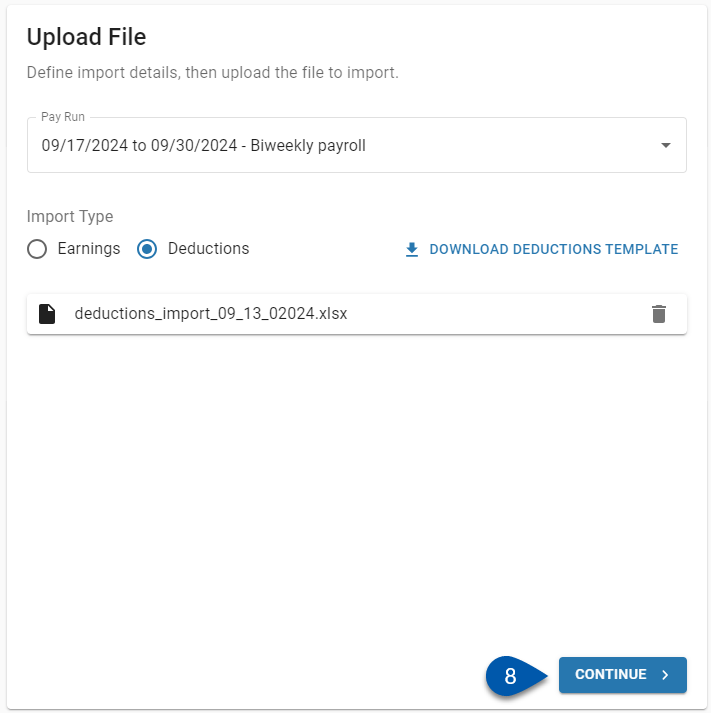

8) Click Continue.

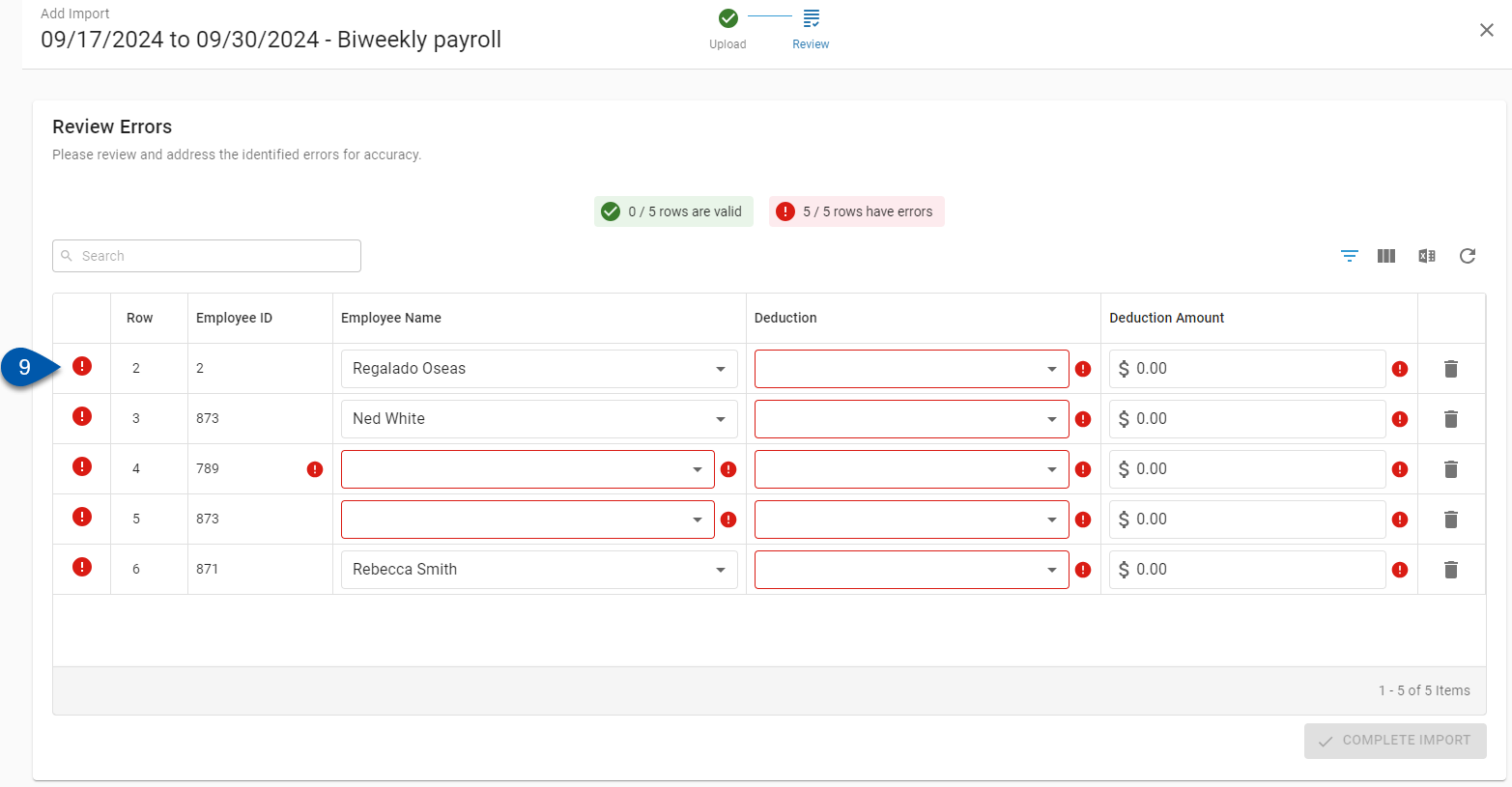

Only rows without errors will be imported.

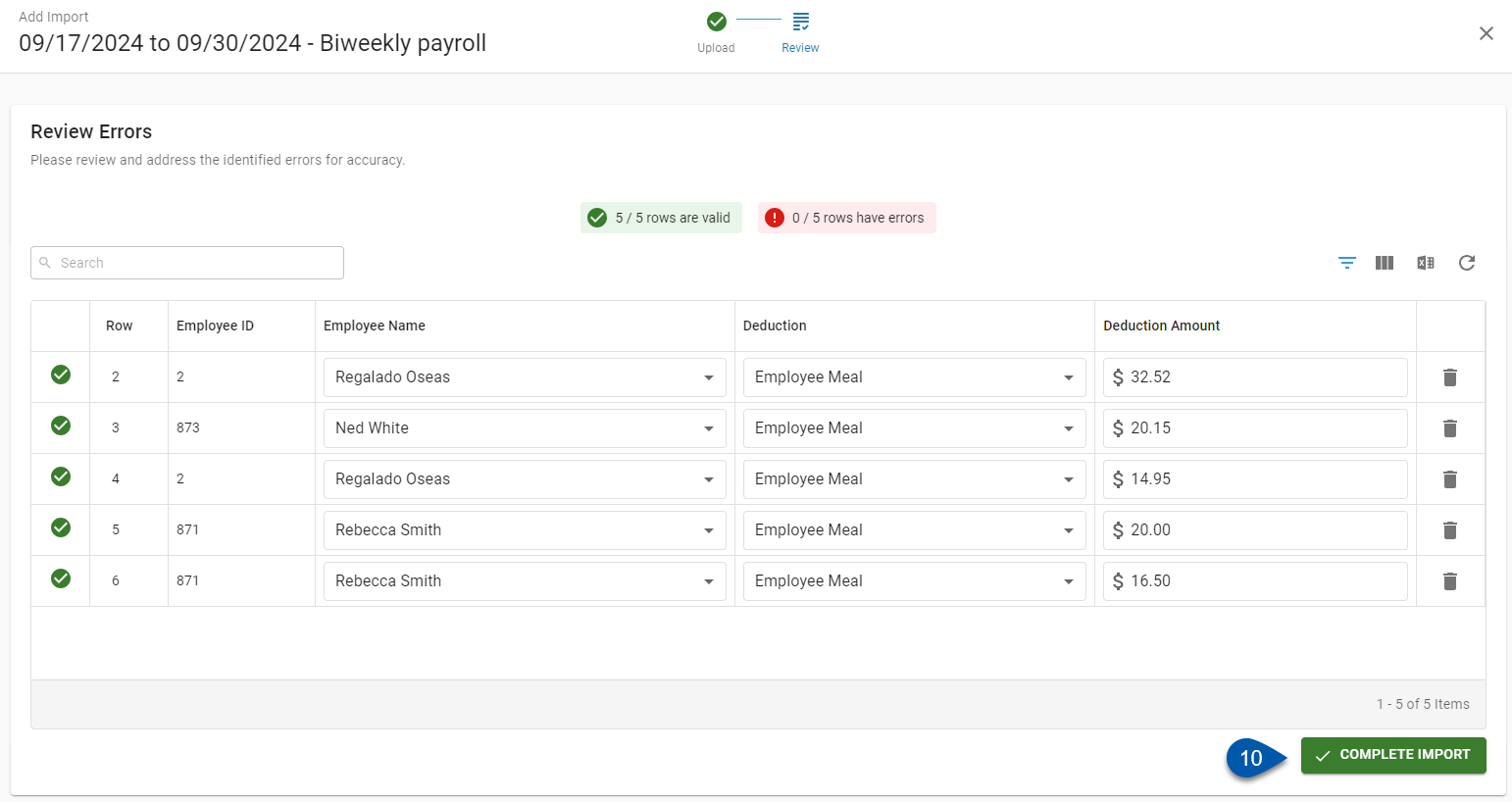

10) Click Complete Import to import rows without errors.