Asset Classes are part of the Fixed Assets module.

Asset Classes serve as templates that are used in the creation of assets. Additionally, Assets can be sorted or organized by asset class. Asset classes can be created manually, or imported through the Setup Assistant. Assigning an Asset Class is required during the creation of an Asset.

While an Asset Class is required to be assigned to an Asset, once selected, the settings and values can be updated as needed.

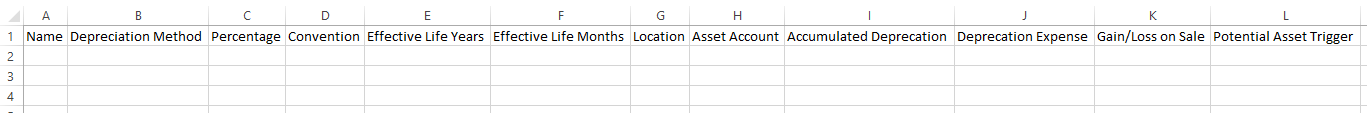

Asset Classes Buttons and Fields

Button/Field | Description | |

|---|---|---|

General | ||

1 | Name | The name of the asset class as it will be displayed in R365. |

2 | Depreciation Method | The method in which the asset will be depreciated. Options include:

Learn more about depreciation method definitions and examples. |

3 | Convention | Sets the depreciation start date for the asset. Additionally, determines the amount of depreciation to record on the first and last months of depreciation. Options include:

Learn more about convention definitions. |

4 | Effective Life | The estimated effective life in years and partial years (months).

|

Accounts | ||

5 | Asset | The account where the current value of the asset will be recorded and updated. |

6 | Accumulated Depreciation | The account where the accumulated depreciation will be recorded and updated. |

7 | Depreciation Expense | The account where the depreciation expense will be recorded and updated. |

8 | Gain/Loss on Sale | The account where the gain/loss on sales will be recorded and updated. |

9 | Potential Asset Trigger | The account the potential asset list will pull from for any new potential assets in this asset class. |

Create an Asset Class

Asset Classes can be created in one of two ways: Setup Assistant or Fixed Assets sub-menu.

Via Setup Assistant

Asset Classes can be created manually, one by one, or several at once through the use of a template.

Single - Manual

Click the 'Add Asset Class' and complete each field to create a single Asset Class.

Multiple - Template

Click 'Export Template' to download the Asset Class Template.

Complete the template in Excel and then save the Template. Make note of where the file is saved as you will need to browse there to select and import it.

GL Accounts, Locations, Depreciation Method, and Conventions must be entered exactly as they appear in R365. If the spelling does not match, the import will fail

Next, click 'Import' to select and import your Asset Classes.

Via Asset Classes Page

Navigate to the Asset classes page, then select Create.

Assign an Asset Class

Once Asset Classes have been created, they will be available to be selected on the Asset record. The Asset Class field is a required field on the Asset record. Select the Asset Class in the Asset Class selector.

Asset Class List

View and manage existing asset classes on the Asset Classes page.